capital gains tax proposal effective date

The Biden administration proposed that its capital gains tax increase apply to gains required to be recognized after the date of announcement presumably late April 2021 The House proposes that its capital gains increase apply to sales on or after Sept. JD CPA PFS.

Export Basmati Rice Basmati Rice Basmati Indian Rice Basmati

Effective Date Considerations May 14 2021.

. An immediate effective date would prevent taxpayers from selling assets and engaging in transactions ahead of the rate increase. Which leads to the oft-asked question of when. The proposal to tax long-term capital gains and qualified dividends for high-income taxpayers at ordinary rates would be effective.

This proposal is aggressive however and moderates are likely to force a compromise. The top rate would be 288. Currently the top ordinary rate for individuals is 37 but the AFP also.

Share to Linkedin. President Bidens American Families Plan proposes increasing the tax rate on long-term. If this were to happen.

The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of. As you review this alert it is critical to keep in. The purpose of backdating tax.

KPMG Catching Up on Capitol Hill Podcast Episode 13-2021 Its not just the how much the capital gains tax rate may increase its the when. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021. It appears that the White House is planning to make the effective date for its proposed tax increase on long-term capital gains retroactive to April 2021.

These provisions would be effective January 1 2022 except the tax rate on capital gains which would be effective April 28 2021 the date that the AFP was released by the White House. The effective date for the capital gains tax hike would be April 28 2021 when the American Families plan was introduced according to the Treasury Departments Greenbook a compendium of. 1 2022 except for the proposed increase in capital gains tax rates which would likely be effective retroactive to April 28 2021.

Understanding Capital Gains and the Biden Tax Plan. Were going to get rid of the loopholes that allow Americans who make more. Catching Up on Capitol Hill Episode 13-2021 President Biden has proposed a substantial increase in the capital gains rate.

Plus a change to the capital gains rules with a midyear effective date eg a 20 top capital gains rate for pre-April 2021 sales and a. The tax on capital gain of property transferred by gift or at death would be effective January 1 2022. For taxpayers with income above 1 million the long-term capital gains rate would increase to.

Bidens Capital Gains Proposal. On Friday the Treasury Departments detailed explanations of President Bidens 6 trillion budget confirmed the administration is seeking a retroactive effective date on a. The estate and gift proposal would be effective for gains on property transferred by gift and on property owned at death by decedents dying after December 31 2021.

President Joe Biden and many progressive Democrats have proposed taxing capital gains as ordinary income at a top rate of 396 to the extent adjusted gross income exceeds 1 million effective for transactions after an unspecified date of announcement. If this were to happen it may not only seem unfair but it is also bad tax policy. Bidens Capital Gains Proposal.

In short we dont yet know the answer to this important question. Biden proposed raising the top capital gains tax from 20 to 396 before a joint session of Congress on April 28. House Democrats proposed a top federal rate of 25 on long-term capital gains according to legislation issued Monday by the House Ways and Means Committee.

This will affect long-term and short-term capital gains since both would be taxed as ordinary income in the highest bracket. For taxpayers with income of over 1 million long-term capital gains will be taxed at ordinary rates. April 27 2021.

The top rate for 2021 is 37 plus. Democratic lawmakers have quietly begun discussing whether to make a proposed increase in the individual capital gains rate effective on the date the proposal is introduced. The Biden tax plan would raise the top marginal income tax rate to 396 from the current 37 level.

13 2021 unless pursuant to a written binding contract effective on. There are exceptions however and some are notable. Biden plans to increase the top tax rate on capital gains to 434 from 238 for households with income over 1 million though Congress must OK any hikes and retroactive effective dates the.

In general the Biden Administration would make its tax proposals effective January 1 2022 which is how budget recommendations are ordinarily submitted. The effective date for most of the proposals is Jan. This may be why the White House is seeking an April 2021 effective date for the retroactive capital gains tax increase as President Biden announced the proposal on April 28 2021 although it was not widely publicized at the time and investors are still becoming aware of it.

The Green Book specifically provides for a retroactive effective date for the capital gains tax increase. In the American Families Plan AFP the Biden Administration is proposing an increased tax rate on capital gains and qualified dividends to equal the top ordinary income tax rate of 396 for households earning over 1 million or 500000 if married filing separately. 13 2021 unless pursuant to a written binding contract effective on or before Sept.

House Democrats Propose Hiking Capital Gains Tax To 28 8

Biden Budget Reiterates 43 4 Top Capital Gains Tax Rate For Millionaires

Tax Consultants In Islamabad Income Tax Return Income Tax Tax Return

Sponsorship Form Template Word Elegant Sample Sponsorship Form 9 Documents In Word Pdf Sponsorship Form Template Templates Word Template

President Biden S Stepped Up Basis Tax Proposal Forbes Advisor

How Did The Tax Cuts And Jobs Act Change Personal Taxes Tax Policy Center

What Is The Stepped Up Basis And Why Does The Biden Administration Want To Eliminate It

Retroactive Effective Date For Capital Gains Tax Increase Is A Bad Idea

How The Tcja Tax Law Affects Your Personal Finances

How To Write Out A Bill Of Sale Opinion Of Experts Bill Of Sale Template Word Template Business Template

How The Tcja Tax Law Affects Your Personal Finances

How Might The Taxation Of Capital Gains Be Improved Tax Policy Center

Historical Capital Gains And Taxes Tax Policy Center

How The Tcja Tax Law Affects Your Personal Finances

Banking Financial Awareness 28 29 30th May 2020 Awareness Study Quotes Banking

A 95 Year History Of Maximum Capital Gains Tax Rates In 1 Chart The Motley Fool

Capital Gains Taxes Are Going Up Tax Policy Center

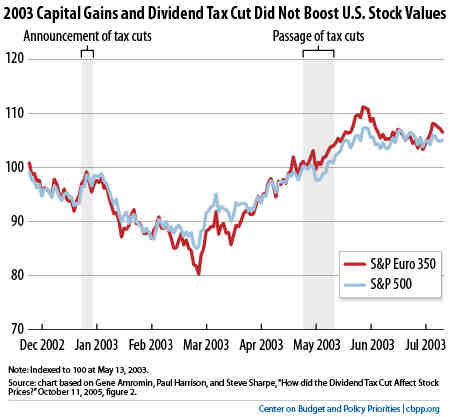

Chart Book 10 Things You Need To Know About The Capital Gains Tax Center On Budget And Policy Priorities